ZIM Stock Price Prediction 2025: Analyzing the Future of Container Shipping

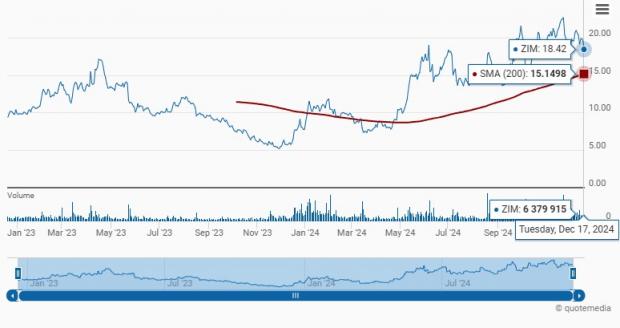

Predicting the future of any stock, especially one as volatile as ZIM Integrated Shipping Services Ltd. (ZIM), requires a comprehensive analysis of various factors. This article delves into a ZIM stock price prediction 2025, examining the key drivers influencing the company’s performance, the challenges it faces, and potential future scenarios. Understanding these elements is crucial for investors considering ZIM as part of their portfolio.

Understanding ZIM Integrated Shipping Services

ZIM Integrated Shipping Services is an Israeli international cargo shipping company. Founded in 1945, it has grown into a significant player in the global container shipping industry. ZIM operates a modern fleet of vessels and provides a wide range of services, including container shipping, logistics, and specialized cargo solutions. The company’s stock, traded on the New York Stock Exchange (NYSE), has experienced significant fluctuations, reflecting the inherent volatility of the shipping market.

Factors Influencing ZIM’s Stock Price

Several factors can impact the ZIM stock price prediction 2025. These include:

- Global Economic Conditions: The health of the global economy directly affects demand for container shipping. Economic slowdowns typically lead to reduced trade and lower shipping rates, negatively impacting ZIM’s revenue and stock price. Conversely, economic growth boosts demand and can drive up rates.

- Supply and Demand Dynamics: The balance between shipping capacity and demand plays a crucial role. Overcapacity in the market can lead to price wars and lower profitability for shipping companies like ZIM. Factors such as new vessel deliveries and scrapping of older ships influence this balance.

- Freight Rates: Freight rates, the prices charged for shipping containers, are a primary driver of ZIM’s revenue. These rates are influenced by factors such as supply chain disruptions, geopolitical events, and seasonal demand.

- Fuel Prices: Fuel costs represent a significant expense for shipping companies. Fluctuations in fuel prices can impact ZIM’s profitability and, consequently, its stock price.

- Geopolitical Events: Events such as trade wars, political instability, and armed conflicts can disrupt global trade routes and impact shipping demand and rates.

- Company-Specific Factors: ZIM’s operational efficiency, cost management, and strategic decisions also influence its performance. Factors like fleet modernization, route optimization, and customer relationships are crucial.

Analyzing the Current Market Landscape

The container shipping industry has experienced significant volatility in recent years. The COVID-19 pandemic initially caused a sharp decline in demand, followed by a surge as economies recovered and consumer spending shifted towards goods. This surge led to record-high freight rates and profits for shipping companies like ZIM. However, as supply chains have normalized and demand has cooled, freight rates have declined significantly from their peak levels.

Currently, the market is facing challenges such as:

- Slowing Economic Growth: Concerns about a potential global recession are weighing on demand for container shipping.

- Increased Capacity: New vessel deliveries are adding capacity to the market, potentially leading to oversupply and lower freight rates.

- Geopolitical Uncertainties: The ongoing war in Ukraine and other geopolitical tensions are creating uncertainty and disrupting trade flows.

Potential Scenarios for ZIM Stock Price in 2025

Given the complex and dynamic nature of the shipping market, it’s helpful to consider several potential scenarios for ZIM stock price prediction 2025:

Optimistic Scenario

In an optimistic scenario, the global economy experiences a rebound, leading to increased demand for container shipping. Supply chain disruptions ease further, but demand remains strong enough to support healthy freight rates. ZIM successfully manages its costs and continues to optimize its operations. In this scenario, the ZIM stock price prediction 2025 could see a significant increase from current levels. This would be driven by higher revenue and profitability.

Base Case Scenario

In a base case scenario, the global economy experiences moderate growth, and the container shipping market remains relatively balanced. Freight rates stabilize at levels lower than the peak but still above pre-pandemic levels. ZIM maintains its market share and profitability. In this scenario, the ZIM stock price prediction 2025 would likely see moderate growth, reflecting the company’s steady performance and dividend payouts.

Pessimistic Scenario

In a pessimistic scenario, the global economy enters a recession, leading to a sharp decline in demand for container shipping. Oversupply in the market puts downward pressure on freight rates, and ZIM’s profitability suffers. Geopolitical tensions further disrupt trade flows. In this scenario, the ZIM stock price prediction 2025 could experience a significant decline, reflecting the challenging market conditions and reduced earnings.

Financial Analysis and Valuation

A thorough financial analysis is essential for making informed investment decisions. Investors should consider ZIM’s financial statements, including its balance sheet, income statement, and cash flow statement. Key metrics to analyze include revenue growth, profitability margins, debt levels, and cash flow generation.

Valuation methods such as price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and discounted cash flow (DCF) analysis can be used to estimate the intrinsic value of ZIM’s stock. However, it’s important to note that these methods rely on assumptions about future growth rates and discount rates, which can be highly uncertain in the shipping industry.

Analysts’ estimates also provide valuable insights into the potential future performance of ZIM’s stock. These estimates reflect the collective expectations of financial professionals who closely follow the company and the industry. However, it’s important to remember that analysts’ estimates are not guarantees and can be subject to change.

Risks and Challenges

Investing in ZIM’s stock involves several risks and challenges:

- Cyclical Nature of the Shipping Industry: The shipping industry is highly cyclical, with periods of strong growth followed by periods of decline. This cyclicality can lead to significant fluctuations in ZIM’s revenue and profitability.

- Exposure to Global Economic Conditions: ZIM’s performance is highly dependent on the health of the global economy. Economic slowdowns can negatively impact demand for container shipping.

- Competition: The container shipping industry is highly competitive, with several large players vying for market share. This competition can put downward pressure on freight rates and profitability.

- Geopolitical Risks: Geopolitical events such as trade wars, political instability, and armed conflicts can disrupt global trade routes and impact shipping demand and rates.

- Regulatory Risks: Changes in regulations related to shipping, such as environmental regulations, can increase costs for shipping companies.

The Importance of Due Diligence

Before investing in ZIM’s stock, it’s crucial to conduct thorough due diligence. This includes:

- Researching the Company: Understanding ZIM’s business model, competitive position, and financial performance.

- Analyzing the Industry: Assessing the current market landscape, trends, and challenges in the container shipping industry.

- Evaluating the Risks: Identifying and assessing the risks associated with investing in ZIM’s stock.

- Consulting with a Financial Advisor: Seeking professional advice from a qualified financial advisor.

Alternative Investments in the Shipping Sector

While focusing on a ZIM stock price prediction 2025 is valuable, exploring alternative investments in the shipping sector can also be beneficial. This could include investments in other shipping companies, logistics providers, or infrastructure companies that support the shipping industry. Diversifying investments can help mitigate risk and potentially enhance returns. [See also: Investing in Maritime Infrastructure]

Conclusion

Predicting the ZIM stock price prediction 2025 is a complex task that requires careful analysis of various factors, including global economic conditions, supply and demand dynamics, freight rates, and geopolitical events. While it is impossible to predict the future with certainty, considering different scenarios and conducting thorough due diligence can help investors make informed decisions. The container shipping industry remains a vital part of the global economy, and understanding its dynamics is crucial for anyone considering investing in companies like ZIM. Investors should weigh the potential risks and rewards carefully and consult with a financial advisor before making any investment decisions. The future of ZIM stock price prediction 2025 hinges on the interplay of these global forces and the company’s strategic responses.