Poly Market: Revolutionizing Prediction Markets with Blockchain Technology

Poly Market has emerged as a prominent player in the burgeoning world of prediction markets, leveraging the power of blockchain technology to offer a unique and innovative platform for forecasting future events. This article delves into the intricacies of Poly Market, exploring its functionality, underlying technology, potential benefits, and associated risks. We aim to provide a comprehensive overview, offering readers a balanced perspective on this fascinating and rapidly evolving platform.

What is Poly Market?

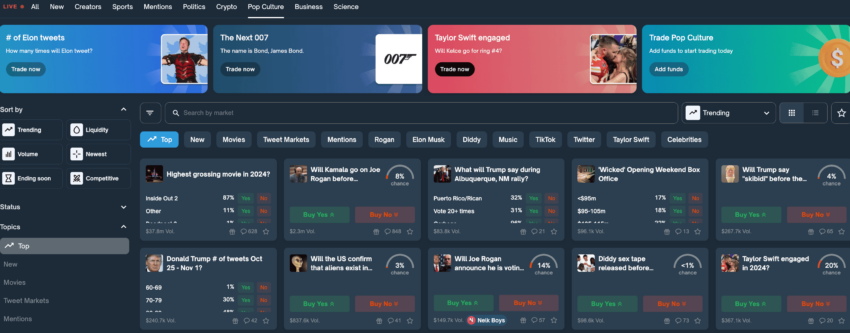

Poly Market is a decentralized prediction market built on the Polygon blockchain. It allows users to trade on the likelihood of future events, ranging from political outcomes and economic indicators to scientific breakthroughs and cultural trends. Unlike traditional prediction markets, Poly Market operates with minimal fees and censorship resistance, thanks to its blockchain-based infrastructure. The platform utilizes stablecoins, typically USDC, for trading and settlement, providing a degree of price stability in the volatile cryptocurrency market. By enabling users to directly participate in predicting future outcomes, Poly Market aims to aggregate information, improve forecasting accuracy, and provide valuable insights into public opinion.

How Does Poly Market Work?

The core functionality of Poly Market revolves around the creation and trading of prediction contracts. Here’s a breakdown of the key components:

- Event Creation: Users can propose new events for prediction, subject to community review and approval. These events must be clearly defined with unambiguous outcomes.

- Contract Creation: For each event, Poly Market creates two binary contracts representing the possible outcomes (e.g., “Yes” or “No”).

- Trading: Users can buy and sell these contracts, with the price reflecting the market’s perceived probability of each outcome. The price ranges from $0.00 to $1.00, representing a probability from 0% to 100%. For example, if a contract for “Yes” is trading at $0.75, the market estimates a 75% chance of that outcome occurring.

- Settlement: Once the event occurs, the contracts are settled based on the actual outcome. Contracts corresponding to the correct outcome are worth $1.00, while incorrect contracts are worth $0.00.

Poly Market’s use of the Polygon blockchain ensures fast and low-cost transactions, making it accessible to a wider audience. The platform’s decentralized nature also promotes transparency and reduces the risk of manipulation.

The Technology Behind Poly Market

Poly Market’s architecture relies on several key technologies:

- Polygon: A layer-2 scaling solution for Ethereum, Polygon enables Poly Market to handle a high volume of transactions with minimal fees. This is crucial for the platform’s usability and scalability.

- Smart Contracts: Smart contracts automate the creation, trading, and settlement of prediction contracts. These self-executing contracts ensure transparency and eliminate the need for intermediaries.

- Stablecoins (USDC): Poly Market utilizes USDC, a stablecoin pegged to the US dollar, for trading and settlement. This provides a stable unit of account and reduces the impact of cryptocurrency volatility.

- Decentralized Oracles: While Poly Market aims for decentralization, it often relies on external oracles to verify the outcomes of real-world events. These oracles provide data feeds that trigger the settlement of prediction contracts.

The integration of these technologies allows Poly Market to offer a seamless and efficient prediction market experience.

Benefits of Using Poly Market

Poly Market offers several potential benefits to its users:

- Information Aggregation: Prediction markets are known for their ability to aggregate information from diverse sources. By allowing users to bet on future events, Poly Market can provide valuable insights into public opinion and market sentiment.

- Improved Forecasting: The collective wisdom of the crowd can often outperform individual experts in forecasting future events. Poly Market harnesses this collective intelligence to generate more accurate predictions.

- Financial Incentives: Users can profit from their accurate predictions, providing a financial incentive to conduct thorough research and make informed decisions.

- Transparency and Censorship Resistance: Poly Market’s blockchain-based infrastructure ensures transparency and reduces the risk of censorship. All transactions are recorded on the blockchain, making them publicly auditable.

- Accessibility: Poly Market is accessible to anyone with an internet connection and a cryptocurrency wallet. This democratizes access to prediction markets and allows a wider range of individuals to participate.

Risks and Challenges Associated with Poly Market

Despite its potential benefits, Poly Market also faces several risks and challenges:

- Regulatory Uncertainty: The regulatory landscape surrounding prediction markets and blockchain technology is still evolving. Poly Market may face regulatory scrutiny in certain jurisdictions.

- Liquidity Issues: Some prediction markets on Poly Market may suffer from low liquidity, making it difficult to buy and sell contracts at desired prices.

- Oracle Risks: The reliance on external oracles introduces the risk of inaccurate or manipulated data feeds. This could lead to incorrect settlement of prediction contracts.

- Market Manipulation: While Poly Market aims to prevent market manipulation, it is still possible for individuals or groups to influence prices through large trades or coordinated efforts.

- Volatility: While USDC provides some stability, the underlying cryptocurrency market can be volatile. This volatility can indirectly impact the value of assets held on Poly Market.

- Smart Contract Risks: As with any smart contract-based platform, there is a risk of bugs or vulnerabilities in the code. These vulnerabilities could be exploited by malicious actors.

Poly Market’s Impact on Prediction Markets

Poly Market has significantly impacted the prediction market landscape by introducing a decentralized, low-cost, and accessible platform. Its innovative use of blockchain technology has attracted a growing community of users and has demonstrated the potential of prediction markets for information aggregation and forecasting. The platform’s success has also inspired other developers to explore the possibilities of decentralized prediction markets.

Real-World Applications of Poly Market

The insights derived from Poly Market can be applied in various real-world scenarios:

- Political Forecasting: Predicting election outcomes and policy decisions.

- Economic Analysis: Forecasting economic indicators such as inflation and GDP growth.

- Risk Management: Assessing the likelihood of various risks, such as natural disasters or cybersecurity breaches.

- Market Research: Gauging consumer sentiment and predicting the success of new products or services.

- Scientific Research: Predicting the outcomes of scientific experiments or the likelihood of breakthroughs.

The Future of Poly Market

The future of Poly Market looks promising, with several potential avenues for growth and development. These include:

- Expanding the range of events: Offering prediction markets on a wider variety of topics and events.

- Improving liquidity: Implementing mechanisms to increase liquidity and reduce price slippage.

- Enhancing decentralization: Further decentralizing the platform by reducing reliance on centralized oracles.

- Integrating with other platforms: Integrating Poly Market with other blockchain-based applications and services.

- Addressing regulatory concerns: Working with regulators to ensure compliance and promote responsible innovation.

Conclusion

Poly Market represents a significant step forward in the evolution of prediction markets. Its innovative use of blockchain technology has created a more accessible, transparent, and efficient platform for forecasting future events. While the platform faces certain risks and challenges, its potential benefits are undeniable. As the regulatory landscape evolves and the technology matures, Poly Market is poised to play an increasingly important role in information aggregation, forecasting, and decision-making. The platform’s ability to harness the collective intelligence of the crowd offers valuable insights that can be applied in a wide range of real-world scenarios. Whether you’re interested in political forecasting, economic analysis, or simply want to test your predictive abilities, Poly Market provides a unique and engaging platform to participate in the future of prediction markets. As the platform continues to evolve, it will be crucial to monitor its progress and assess its impact on the broader ecosystem. The future of prediction markets is here, and Poly Market is at the forefront of this exciting revolution. Trading on Poly Market involves risks, and it’s essential to understand these risks before participating. [See also: Decentralized Prediction Markets] The platform offers a unique way to engage with forecasting, but users should always conduct thorough research and exercise caution. The use of stablecoins like USDC on Poly Market aims to mitigate volatility, but it’s not a guarantee against losses. Poly Market is a valuable tool for aggregating information, but it’s not a substitute for professional advice. The platform’s decentralized nature offers transparency, but it also comes with the responsibility of understanding the underlying technology and its limitations. Poly Market is changing the way people think about prediction markets, and its impact is likely to grow in the years to come. Poly Market is built on the Polygon blockchain, ensuring fast and low-cost transactions. One of the key advantages of Poly Market is its accessibility. Poly Market allows users to trade on the likelihood of future events. The platform utilizes stablecoins for trading and settlement on Poly Market. By enabling users to directly participate, Poly Market aims to improve forecasting accuracy. The core functionality of Poly Market revolves around the creation and trading of prediction contracts. Poly Market’s architecture relies on several key technologies. Poly Market offers several potential benefits to its users. There are regulatory uncertainties surrounding Poly Market. Some prediction markets on Poly Market may suffer from low liquidity. The insights derived from Poly Market can be applied in various real-world scenarios. The future of Poly Market looks promising with several potential avenues for growth. Poly Market represents a significant step forward in the evolution of prediction markets.