Understanding the Salt Deduction: A Comprehensive Guide

The State and Local Tax (SALT) deduction has been a significant point of discussion in US tax policy, particularly since the Tax Cuts and Jobs Act (TCJA) of 2017. This comprehensive guide aims to provide a clear understanding of the salt deduction, its implications, and how it affects taxpayers. We’ll explore the history of the deduction, the changes brought about by the TCJA, and the ongoing debates surrounding it. Whether you’re a seasoned tax professional or simply trying to understand your tax bill, this article will provide valuable insights into the complexities of the salt deduction.

What is the Salt Deduction?

The salt deduction allows taxpayers to deduct certain state and local taxes from their federal income tax liability. These taxes primarily include:

- State and local property taxes

- State and local income taxes (or sales taxes, in some cases)

Before the TCJA, taxpayers could deduct the full amount of these taxes. However, the TCJA introduced a limitation on the salt deduction, capping it at $10,000 per household. This change has had a significant impact on taxpayers, particularly those in high-tax states.

History of the Salt Deduction

The salt deduction has been a part of the US tax code since its inception in 1913. The original intent was to alleviate the burden of state and local taxes on taxpayers, preventing them from being taxed twice on the same income – once by state and local governments, and again by the federal government. This deduction also aimed to promote fiscal federalism, allowing states and localities to raise revenue without unduly burdening their residents.

For over a century, the salt deduction remained largely unchanged, providing a significant tax benefit to millions of Americans. However, the TCJA brought about substantial alterations, sparking considerable debate and controversy.

The Tax Cuts and Jobs Act (TCJA) and the Salt Deduction Cap

The TCJA, enacted in 2017, significantly altered the landscape of the salt deduction. The most impactful change was the introduction of a $10,000 cap on the amount of state and local taxes that could be deducted. This cap applied to both single filers and married couples filing jointly, effectively limiting the tax benefit for many households, especially those in states with high property taxes and income taxes.

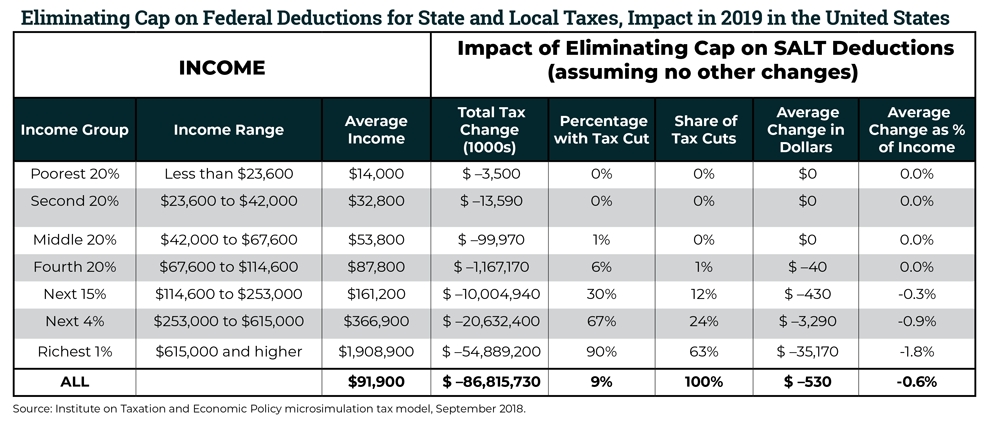

The rationale behind the salt deduction cap was multifaceted. Proponents argued that it would help offset the cost of other tax cuts included in the TCJA, making the overall legislation more fiscally sustainable. They also contended that the salt deduction disproportionately benefited wealthier taxpayers in high-tax states, effectively subsidizing their state and local governments at the expense of taxpayers in lower-tax states. [See also: Tax Reform and Its Impact on States]

Impact of the Salt Deduction Cap

The $10,000 cap on the salt deduction has had a varied impact across different states and income groups. Taxpayers in states with high state and local taxes, such as New York, California, New Jersey, and Illinois, have been disproportionately affected. Many residents in these states pay more than $10,000 in combined property and income taxes, meaning they can no longer deduct the full amount.

The impact of the salt deduction limit also varies by income level. While the cap affects some high-income earners, middle-class families in high-tax states have also felt the pinch. For example, a family with a home valued at $500,000 in a state with high property taxes could easily exceed the $10,000 limit, reducing their federal tax savings.

Arguments For and Against the Salt Deduction

The salt deduction has been a subject of intense debate, with proponents and opponents offering compelling arguments. Understanding these arguments is crucial for grasping the complexities of this tax policy.

Arguments in Favor of the Salt Deduction

- Prevents Double Taxation: Supporters argue that the salt deduction prevents double taxation by allowing taxpayers to deduct state and local taxes from their federal income. Without the deduction, taxpayers would effectively be paying taxes on taxes.

- Promotes Fiscal Federalism: The salt deduction allows states and localities to raise revenue without unduly burdening their residents, supporting fiscal federalism. It enables them to fund essential services like education, infrastructure, and public safety.

- Fairness and Equity: Some argue that the salt deduction promotes fairness by recognizing the varying tax burdens across different states. It helps equalize the tax burden for taxpayers in high-tax states compared to those in low-tax states.

Arguments Against the Salt Deduction

- Disproportionate Benefit to High-Income Earners: Opponents argue that the salt deduction disproportionately benefits high-income earners, who are more likely to itemize deductions and live in high-tax states. This effectively subsidizes wealthier taxpayers at the expense of those in lower-tax states.

- Fiscal Cost: The salt deduction is expensive, costing the federal government billions of dollars in lost revenue each year. Limiting or eliminating the deduction could free up funds for other priorities.

- Distortion of State and Local Tax Policies: Critics argue that the salt deduction can distort state and local tax policies by encouraging states to raise taxes, knowing that their residents can deduct them on their federal returns. This can lead to inefficient resource allocation.

Potential Workarounds and Strategies

Taxpayers and state governments have explored various strategies to mitigate the impact of the salt deduction cap. Some of these strategies include:

- State and Local Tax Credit Programs: Some states have implemented programs that allow taxpayers to contribute to state-sponsored charities in exchange for a state tax credit. These contributions may be deductible as charitable contributions on federal tax returns, effectively circumventing the salt deduction cap.

- Pass-Through Entity (PTE) Taxes: Several states have enacted PTE tax laws, which allow pass-through entities (such as partnerships and S corporations) to pay state income taxes at the entity level. The owners of these entities can then deduct the state tax payment on their federal returns, bypassing the salt deduction limit.

- Itemizing vs. Standard Deduction: Taxpayers should carefully consider whether to itemize deductions or take the standard deduction. For some, the standard deduction may be more beneficial, especially if their state and local taxes are below the $10,000 cap.

The Future of the Salt Deduction

The future of the salt deduction remains uncertain. The TCJA’s provisions, including the salt deduction cap, are set to expire at the end of 2025. Congress will need to decide whether to extend, modify, or repeal these provisions. The outcome will have significant implications for taxpayers across the country.

Several proposals have been put forward to address the salt deduction issue. Some policymakers have suggested raising the cap, while others have advocated for its complete repeal. The debate is likely to continue in the coming years, as lawmakers grapple with the complexities of tax policy and the competing interests of different states and income groups.

Conclusion

The salt deduction is a complex and controversial aspect of US tax policy. The TCJA’s $10,000 cap has had a significant impact on taxpayers, particularly those in high-tax states. Understanding the history, implications, and ongoing debates surrounding the salt deduction is crucial for navigating the tax landscape. As the future of the deduction remains uncertain, taxpayers should stay informed and consider strategies to minimize their tax liability. The salt deduction continues to be a focal point of tax discussions, and its evolution will undoubtedly shape the financial landscape for years to come. [See also: Understanding Federal Tax Policy Changes]

Ultimately, the salt deduction underscores the intricate relationship between federal, state, and local tax systems, highlighting the need for ongoing evaluation and reform to ensure fairness and efficiency. The discussion surrounding the salt deduction is far from over, and taxpayers should remain vigilant about potential changes and their impact on their financial well-being.