Understanding Hennepin County Property Tax: A Comprehensive Guide

Navigating the complexities of Hennepin County property tax can be daunting for homeowners and prospective buyers alike. This comprehensive guide aims to demystify the process, providing clear and concise information about assessment, payment, appeals, and resources available to taxpayers within Hennepin County. Understanding your property tax obligations is crucial for financial planning and avoiding potential penalties. Whether you’re a long-time resident or new to the area, this article will equip you with the knowledge you need to manage your Hennepin County property tax effectively.

What is Hennepin County Property Tax?

Property tax is a primary source of revenue for local governments, funding essential services such as schools, roads, public safety, and parks. In Hennepin County, the property tax system is based on the market value of your property. The county assessor determines this value, and the tax rate is then applied to calculate the amount you owe. It’s important to remember that property tax is not a fixed amount; it can fluctuate based on changes in your property’s value, local government budgets, and legislative decisions.

How is Property Value Assessed in Hennepin County?

The Hennepin County Assessor’s Office is responsible for determining the market value of all taxable properties within the county. This assessment is typically conducted annually, considering various factors that influence a property’s worth. These factors include:

- Location: Proximity to amenities, schools, and transportation.

- Size and Condition: The square footage, number of rooms, and overall condition of the building.

- Comparable Sales: Recent sales of similar properties in the neighborhood.

- Improvements: Any additions or renovations that enhance the property’s value.

It’s crucial to understand that the assessed value may not always perfectly align with your perceived market value. The assessor uses mass appraisal techniques, which can sometimes result in discrepancies. If you believe your assessment is inaccurate, you have the right to appeal.

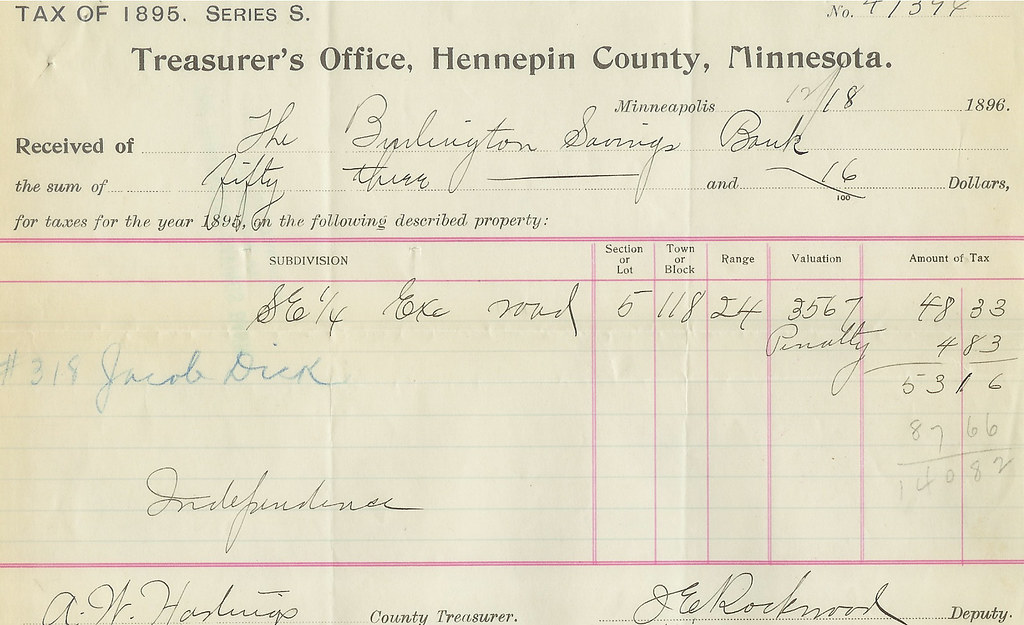

Understanding Your Hennepin County Property Tax Statement

The Hennepin County property tax statement can seem confusing at first glance, but it contains important information about your property tax obligations. Key components of the statement include:

- Property Identification Number (PIN): A unique identifier for your property.

- Assessed Value: The market value determined by the county assessor.

- Tax Rate: The rate applied to the assessed value to calculate your tax liability. This is usually expressed as a percentage.

- Taxable Value: The assessed value after any applicable exemptions or credits.

- Total Tax Due: The total amount of property tax you owe for the year.

- Payment Schedule: The dates by which your property tax payments are due.

Carefully review your property tax statement each year to ensure accuracy and understand your payment obligations.

Hennepin County Property Tax Payment Options

Hennepin County offers several convenient options for paying your property tax:

- Online Payment: Pay securely online through the Hennepin County website using a credit card or e-check.

- Mail: Send a check or money order to the address provided on your property tax statement.

- In-Person: Visit the Hennepin County Government Center or a designated payment location to pay in person.

- Escrow Account: If you have a mortgage, your lender may include property tax payments in your monthly escrow account.

Always ensure you pay your property tax on time to avoid penalties and interest charges.

Appealing Your Hennepin County Property Tax Assessment

If you disagree with your Hennepin County property tax assessment, you have the right to appeal. The appeal process typically involves the following steps:

- Contact the Assessor’s Office: Discuss your concerns with the assessor and provide any evidence supporting your claim.

- File a Formal Appeal: If you’re not satisfied with the assessor’s response, file a formal appeal with the local board of equalization.

- County Board of Equalization: If you disagree with the decision of the local board, you can appeal to the Hennepin County Board of Equalization.

- Minnesota Tax Court: As a final step, you can appeal to the Minnesota Tax Court.

The deadline for filing an appeal is typically in the spring, so it’s crucial to act promptly if you believe your assessment is inaccurate. Gather evidence such as comparable sales data, independent appraisals, and documentation of any property defects to support your appeal.

Hennepin County Property Tax Exemptions and Credits

Hennepin County offers several property tax exemptions and credits to eligible homeowners. These exemptions can significantly reduce your property tax liability. Common exemptions and credits include:

- Homestead Exemption: Available to homeowners who occupy their property as their primary residence. This exemption reduces the taxable value of your property.

- Senior Citizen Property Tax Deferral: A program that allows eligible senior citizens to defer a portion of their property tax.

- Disabled Veteran’s Exemption: Provides a property tax exemption for disabled veterans and their surviving spouses.

- Market Value Homestead Exclusion: Reduces the taxable value for properties with relatively low market values.

Review the eligibility requirements for each exemption and credit to determine if you qualify. Applying for these exemptions can result in substantial savings on your Hennepin County property tax bill.

Resources for Hennepin County Property Tax Payers

Hennepin County provides a variety of resources to assist taxpayers with their property tax obligations:

- Hennepin County Assessor’s Office: Offers information about property assessments, appeals, and exemptions.

- Hennepin County Treasurer’s Office: Handles property tax payments and provides payment options.

- Hennepin County Website: Features online tools and resources for managing your property tax.

- Taxpayer Assistance Programs: Provides assistance to low-income homeowners and seniors.

Utilize these resources to stay informed about your property tax obligations and access the support you need.

The Impact of Hennepin County Property Tax on the Community

Hennepin County property tax revenue plays a vital role in funding essential public services that benefit the entire community. These services include:

- Schools: Funding for public education, including teacher salaries, classroom resources, and school facilities.

- Roads and Infrastructure: Maintenance and construction of roads, bridges, and other infrastructure projects.

- Public Safety: Funding for police, fire departments, and emergency medical services.

- Parks and Recreation: Maintaining parks, trails, and recreational facilities for public use.

- Social Services: Providing support to vulnerable populations, including low-income families, seniors, and individuals with disabilities.

Understanding the impact of property tax on the community can help taxpayers appreciate the importance of fulfilling their obligations and participating in the local budget process.

Staying Informed About Hennepin County Property Tax Changes

The Hennepin County property tax system is subject to change due to legislative decisions, budget adjustments, and economic factors. It’s important to stay informed about these changes to effectively manage your property tax obligations. You can stay updated by:

- Subscribing to the Hennepin County Newsletter: Receive updates and announcements directly to your inbox.

- Monitoring the Hennepin County Website: Check for updates on property tax policies and procedures.

- Attending Local Government Meetings: Participate in public discussions about property tax issues.

- Consulting with a Tax Professional: Seek expert advice on property tax matters.

By staying informed, you can proactively address any changes that may affect your Hennepin County property tax bill.

Conclusion

Navigating the Hennepin County property tax system requires understanding the assessment process, payment options, appeal procedures, and available exemptions. By utilizing the resources provided by Hennepin County and staying informed about changes, you can effectively manage your property tax obligations and contribute to the well-being of the community. This guide serves as a starting point for your Hennepin County property tax journey, empowering you to make informed decisions and navigate the complexities with confidence. Remember to always verify information with official Hennepin County sources for the most up-to-date and accurate details. [See also: Understanding Property Tax Assessments] [See also: How to Appeal Your Property Tax Bill] [See also: Property Tax Exemptions for Seniors]